Your message has been sent

Tokenizing Real Estate: A Step-by-Step Guide For Asset Owners

Looking to tokenize your real estate? Our guide offers asset owners an in-depth, step-by-step approach to converting assets into tradable digital tokens and raising capital globally.

Recent

Real estate has always faced major challenges: illiquidity, high capital requirements, and time-consuming transactions. But that’s changing fast. Blockchain technology is transforming property ownership through tokenization, turning physical assets into digital tokens that are easier to sell, trade, and manage. For asset owners, this offers an entirely new way to raise capital, attract global investors, and unlock liquidity.legal and regulatory processes. This makes it difficult for investors to exit quickly or respond swiftly to changing market conditions. In particular, Real Estate Tokenization Dubai initiatives are leading this transformation by combining forward-thinking regulation with cutting-edge blockchain infrastructure.

Why It Matters Now

Tokenized real estate is on the rise. Deloitte predicts the market could exceed $4 trillion globally by 2035. In Dubai, the Land Department expects tokenized assets to represent up to 7% of the market by 2033, equal to AED 60 billion (USD 16 billion).

As blockchain and DeFi technologies mature, tokenization is set to revolutionize how asset owners finance, manage, and grow their portfolios.

What is Real Estate Tokenization?

At its core, tokenization means converting ownership or economic rights in real estate into digital tokens on the blockchain. Each token represents a fractional share of the property — much like micro-shares in a company — making it easy to trade or transfer.

These tokens live on a secure, transparent blockchain ledger and are managed through smart contracts, which automate everything from rent payouts to ownership changes — without the need for lawyers, brokers, or escrow.

You can tokenize a wide range of assets:

- Residential: villas, apartments, townhouses.

- Commercial: office buildings, retail units, warehouses.

- Development projects: raise capital across different phases.

- Real estate funds & REITs: enhance liquidity and accessibility.

In Dubai, this flexibility is being harnessed to its full potential. Platforms focused on tokenized real estate in Dubai are already providing asset owners with the tools to fractionalize high-value properties and onboard investors globally.

The Problem: Real Estate Is Illiquid

Access Global Investors

Break free from traditional fundraising limits. Tokenization lets you reach a broader investor base, including international and retail investors.

Unlock Liquidity

Real estate is historically illiquid. With tokenized assets, investors can buy or sell fractions on secondary markets — giving them flexibility and making your project more attractive.

Raise Capital Faster

Compared to bank loans or equity rounds, tokenization offers faster and more flexible fundraising. You can sell part of the equity while keeping control of the asset.

Reduce Costs & Paperwork

Smart contracts automate much of the process, reducing legal, brokerage, and admin fees. Transactions become quicker, safer, and more efficient.

Build Trust with Transparency

Blockchain offers an immutable record of ownership and transactions. This boosts confidence and reduces fraud risks for all stakeholders.

In highly regulated markets like Dubai, this transparency is a core driver of institutional adoption.

At the core of Proptle’s innovation is the B-DEX, a decentralized exchange that powers real-time liquidity for tokenized real estate.

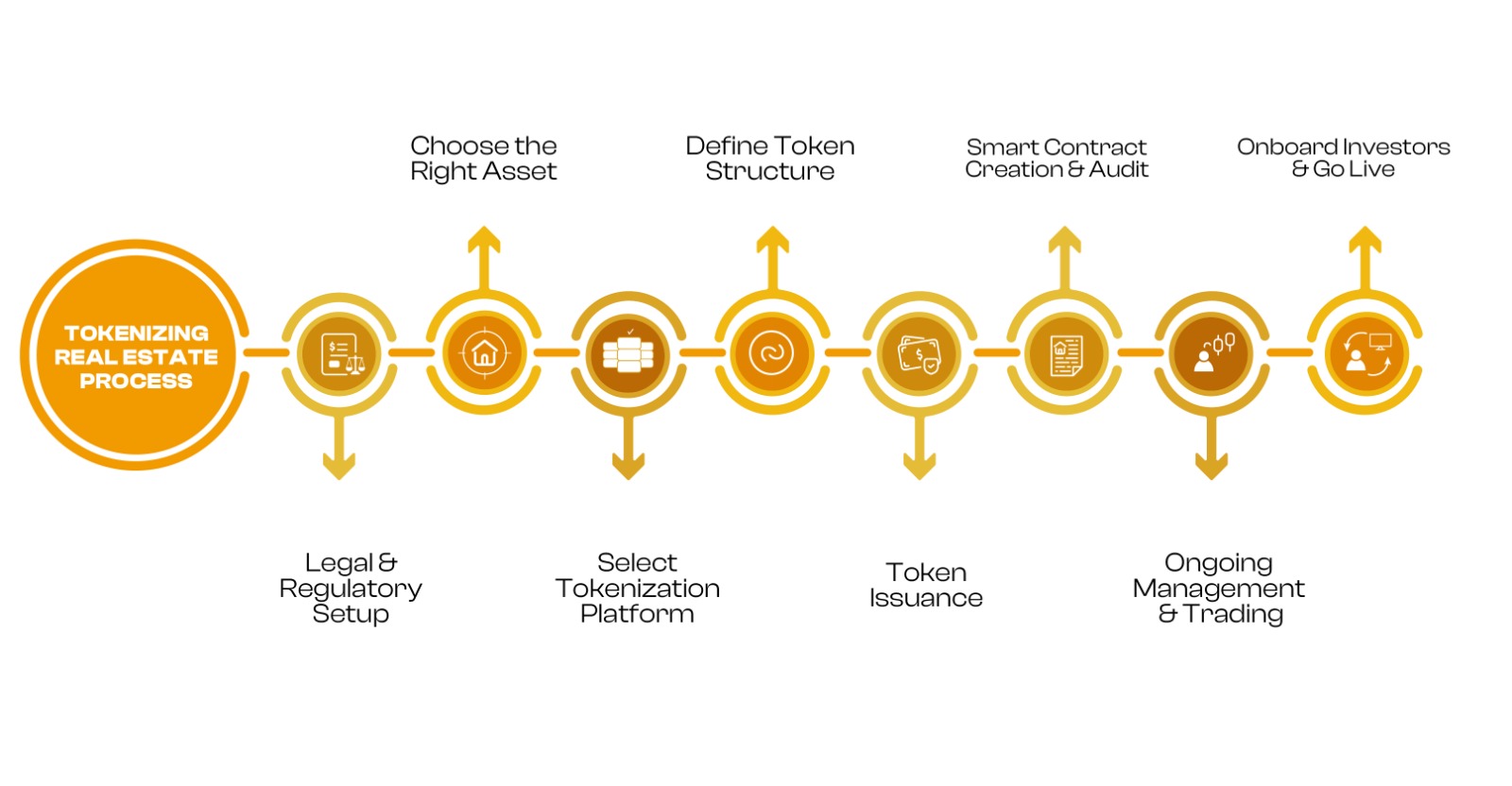

A Step-by-Step Guide to Tokenizing Real Estate

- Fixed Pricing Model

B-DEX uses a fixed pricing model for its tokenized assets. This ensures that token prices remain predictable, providing investors with a stable and transparent pricing structure without the volatility often seen in market-driven pricing systems. - AI Agents for Supply and Demand Management

AI agents autonomously manage supply and demand, ensuring fair value for all assets listed on the platform. This helps maintain a balanced market and seamless liquidity. - Instant Liquidity

With Proptle, there’s no waiting for buyers. Tokens can be sold instantly, directly through the decentralized exchange, allowing for immediate access to capital.

Successfully starting the process of tokenizing real estate requires careful planning and execution: This isn’t just a better version of real estate investing; it’s a whole new category. One where your property tokens behave like liquid assets, not locked-up capital.

Step 1: Choose the Right Asset

Select a property with clear ownership, good market value, and strong rental or appreciation potential. Get a professional valuation to inform token pricing.

Step 2: Legal & Regulatory Setup

Imagine selling your share in a real estate project as easily as selling a stock. Or staking your tokens to earn passive income. With Proptle, this is already a reality.

Ensure compliance with your local real estate and digital asset laws.

In Dubai, for example, align with VARA and follow all KYC/AML rules. Legal support is essential here.

Step 3: Define the Token Structure

- How many tokens will represent the asset?

- What rights do token holders get? (e.g., profit-sharing, governance)

- Will a legal entity like an SPV hold the asset?

Step 4: Select a Tokenization Platform

Choose a secure, blockchain-based platform (e.g., Proptle) with built-in compliance, smart contracts, and investor tools.

Step 5: Smart Contract Creation & Audit

Develop the smart contracts that automate payouts, voting, and transfers.

Audit them thoroughly to avoid bugs or vulnerabilities.

Why Liquidity Matters More Than Ever

Step 6: Token Issuance

"Mint" the digital tokens on your selected blockchain.

These now represent fractional ownership and are linked to the real-world asset.

Step 7: Onboard Investors & Go Live

Use verified KYC/AML processes to onboard investors. Promote your offering through digital channels, marketplaces, or private sales.

Educate potential backers on how tokenized real estate works.

Step 8: Ongoing Management & Trading

After launch, smart contracts handle dividend payments and updates.

Tokens can be traded on secondary markets, giving your asset real-time liquidity and value flexibility.

Blockchain: The Technology Making It Possible

Final Words

Real estate tokenization is more than a trend — it’s a powerful tool that empowers asset owners to modernize their approach to capital, liquidity, and asset management.

- Smart contracts automate ownership, payouts, and transfers

By breaking down barriers and simplifying complex processes, tokenization opens the door to global investors, streamlined operations, and a more flexible way to manage and grow property portfolios. As adoption accelerates, those who embrace tokenized real estate now will be positioned to lead the next wave of property innovation..

Related Blogs

blockchain

How Real Estate Tokenization Enhances Liquidity in Traditionally Illiquid Markets

by | 3 months ago

blockchain

Real Estate Tokenization in Dubai: A Blockchain-Powered Investment Revolution

by | 4 months ago

blockchain

Shariah-Compliant Real Estate Investment: How Blockchain Is Empowering Ethical Finance

by | 4 months ago

blockchain

The Complete Guide to Legal & Regulatory Compliance in Real Estate Tokenization

by | 3 months ago