Your message has been sent

The Complete Guide to Legal & Regulatory Compliance in Real Estate Tokenization

Recent

Real estate tokenization development is reshaping the centuries-old property market, promising to unlock unprecedented liquidity, foster fractional ownership, and democratize access to high-value assets. By leveraging blockchain to convert traditional real estate into digital tokens, it offers a glimpse into a future where property investment is as fluid as trading stocks. For astute investors, understanding the intricate legal and regulatory landscape is not merely about compliance but about identifying secure, transparent, and high-potential tokenized property investment opportunities.

Real Estate Tokenization: Unlocking New Investment Frontiers

At its core, real estate tokenization involves digitizing ownership or economic rights in a physical property. These digital tokens, residing on a blockchain, represent a fractional share of the asset. This mechanism allows investors to buy and sell portions of a property, significantly lowering the entry barrier for tokenized property investment and making multi-million dollar assets accessible to a broader range of investors. The blockchain ensures transparency and immutability of records and can automate various processes like rent distribution and voting rights through smart contracts, offering a secure and efficient investment vehicle.

Global Regulatory Leadership: Securing Your Tokenized Investments Across Borders

The decentralized and cross-border nature of blockchain presents a unique challenge: differing national legal frameworks. Understanding these nuances is crucial for any real estate tokenization development and for ensuring the security and validity of your investments. Leading jurisdictions are actively creating robust environments to attract and protect investors.

1. United States: Structured for Investor Confidence

In the U.S., the Securities and Exchange Commission (SEC) classifies tokenized real estate as securities, especially when there’s an expectation of profit from others' efforts (as per the Howey Test). Tokenized real estate offerings must comply with federal securities laws. To facilitate this, exemptions like Regulation D (for accredited investors) or Regulation A+ (for broader public participation) are often used. The SEC's clear guidance promotes growth within a legal framework, ensuring these offerings remain compliant and attractive to diverse investor profiles.

2. European Union: Harmonized for Predictability

The European Union is leading the way with the Markets in Crypto-Assets (MiCA) regulation, set to fully take effect by December 2024 for crypto-asset service providers (CASPs) and by 2025 for other provisions. MiCA aims to create a harmonized regulatory framework across all member states, offering a predictable and secure environment for tokenized property investment. Tokenized real estate, classified as an "asset-referenced token" (ART) or "e-money token" (EMT), will fall under MiCA, ensuring rigorous white paper requirements, comprehensive investor protection, and robust governance for issuers and CASPs.

3. United Kingdom: Innovation in a Regulated Sandbox

In the UK, the Financial Conduct Authority (FCA) supervises security tokens under existing financial regulations. To foster innovation while ensuring investor protection, the UK launched the Digital Securities Sandbox (DSS), a collaboration between the FCA and the Bank of England. This initiative allows firms to experiment with Distributed Ledger Technology (DLT)-based securities activities, such as real estate tokenization, in a controlled and regulated environment. The DSS facilitates the issuance, trading, and settlement of digital securities on distributed ledgers, positioning the UK as a leader in real estate tokenization development.

4. Switzerland: A Proven Path for Digital Assets

Switzerland remains a global leader in digital asset regulation with its Distributed Ledger Technology (DLT) Act. Effective since February 2021, the DLT Act legally recognizes DLT-based securities, enabling the tokenization of assets like bonds, shares, and derivatives. The Swiss Financial Market Supervisory Authority (FINMA) classifies tokens as payment, utility, and asset tokens, providing legal certainty for investors in tokenized real estate. By integrating DLT into existing financial market laws, Switzerland offers a predictable, investor-friendly environment for tokenized property investments.

5. Asia-Pacific: Singapore Leading the Charge

Singapore’s Monetary Authority (MAS) regulates tokenized Real World Assets (RWAs) under its Securities and Futures Act (SFA), classifying tokens into payment, utility, and asset tokens. In 2022, MAS introduced the Digital Token Service Providers (DTSP) framework, which mandates licensing for digital token service providers. The framework, effective from June 2025, requires compliance with anti-money laundering standards even for overseas clients. MAS is also piloting the tokenization of fixed-income and asset management products through Project Guardian, showcasing the benefits of tokenization in enhancing liquidity and efficiency.

6. UAE (Dubai): Paving the Way for Global Real Estate Tokenization

Dubai is rapidly becoming a global hub for real estate tokenization. The Dubai Land Department (DLD), in collaboration with the Virtual Assets Regulatory Authority (VARA) and the Dubai Future Foundation (DFF), has launched the Real Estate Tokenization Project. This initiative aims to digitize real estate assets and enable fractional ownership through blockchain. The pilot platform, Prypco Mint, allows investors to purchase tokenized shares in Dubai properties for as low as AED 2,000. With projections indicating that tokenized real estate could account for up to 7% of Dubai’s real estate transactions by 2033 (approximately AED 60 billion), Dubai is well-positioned to lead the global real estate tokenization movement.

Critical Compliance Pillars for Secure Tokenized Property Investment

Understanding key compliance pillars is essential for investors to secure tokenized property investments. These pillars ensure a transparent, secure, and legally compliant environment:

Token Classification and Legal Structuring: Ensuring that your token accurately represents ownership in the underlying property (e.g., via an SPV).

Anti-Money Laundering (AML) & Know Your Customer (KYC): Robust procedures to verify investor identities and ensure funds are traced and compliant with international standards like FATF recommendations.

Smart Contract Enforceability: Ensuring that smart contracts governing rent distributions, voting rights, and other processes are legally enforceable.

Custody and Asset Safeguarding: Secure third-party custodians safeguard digital tokens, ensuring protection from cyber threats.

Taxation Clarity: Understanding tax implications (e.g., capital gains, income tax) is crucial for proper financial planning.

Transparent Disclosure & Investor Protection: Full disclosure of risks, terms, and underlying assets empowers investors to make informed decisions.

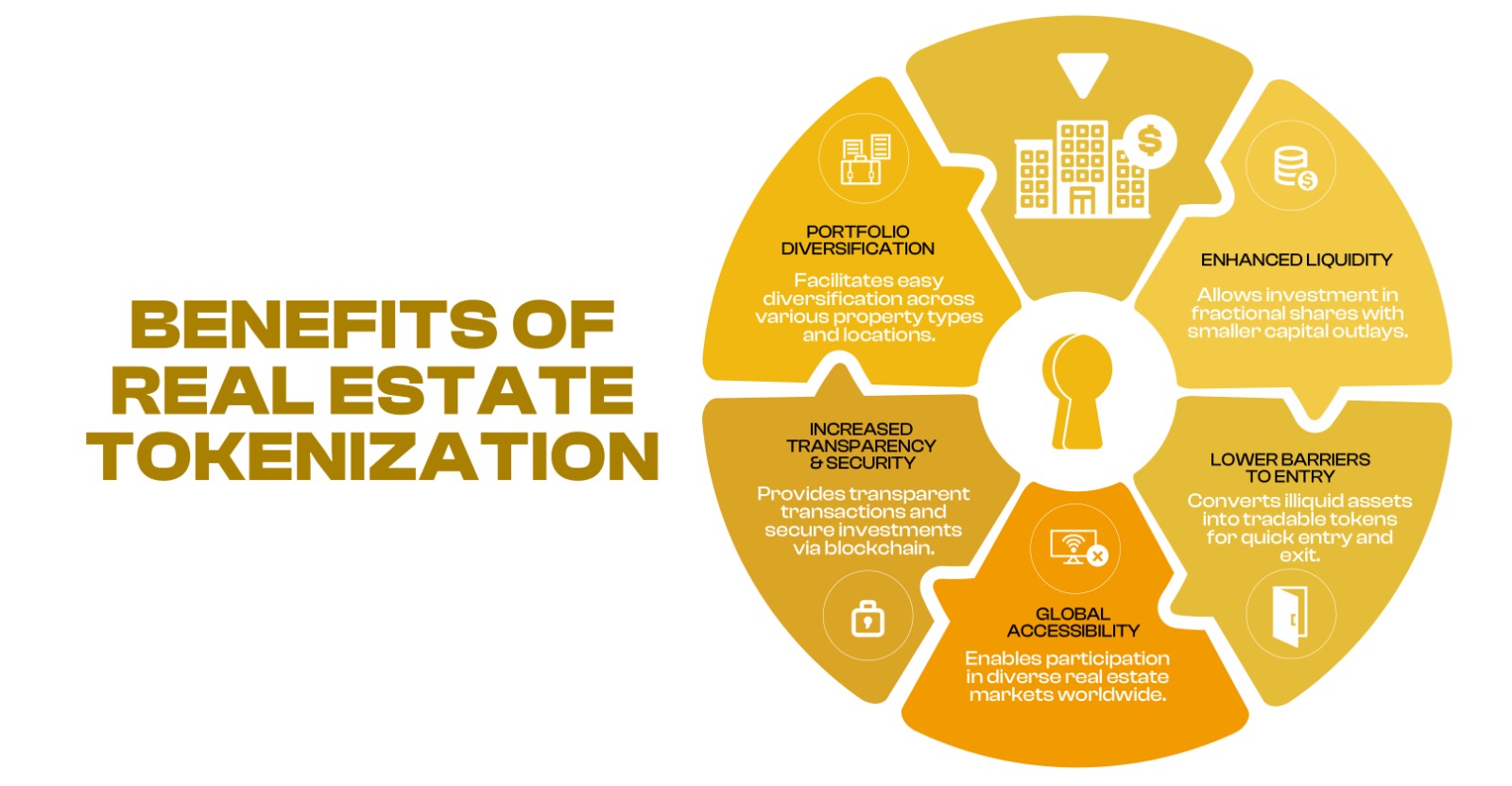

The Investor Advantage: Benefits of Compliant Real Estate Tokenization

Investing in compliant real estate tokenization development offers compelling benefits:

- Enhanced Liquidity: Convert traditionally illiquid assets into easily tradable digital tokens, allowing for quicker entry and exit from investments.

- Lower Barriers to Entry: Invest in fractional shares of high-value properties with smaller capital outlays, democratizing access to premium assets.

- Global Accessibility: Participate in diverse real estate markets worldwide from your desktop, breaking down geographical investment barriers.

- Increased Transparency & Security: Blockchain's immutable ledger provides unparalleled transparency for all transactions, while robust compliance offers a secure investment environment.

- Portfolio Diversification: Easily diversify your investment portfolio across various property types and locations without the complexities of traditional real estate purchases.

Future Outlook: A New Era for Real Estate Investment

The future of tokenized property investment is bright. Key trends include:

- Accelerated Institutional Adoption: Major financial institutions are entering the tokenized real estate space, bringing expertise and capital.

- Seamless Integration with Traditional Finance: Hybrid models are emerging, allowing tokenized real estate to be collateralized for traditional loans and integrated into investment portfolios.

- Explosion of Fractional Ownership Opportunities: A growing demand for accessible, high-yield tokenized properties will lead to more opportunities across various asset types.

- Advanced Regulatory Clarity: Clearer guidelines and cross-border harmonization will enhance the efficiency of tokenized property investment.

- Dubai's Continued Leadership: Dubai’s strategic initiatives, like the Real Estate Tokenization Sandbox and its regulatory stance, make it a global leader in this space.

End Words

Real estate tokenization is more than just a technological advancement; it's a paradigm shift for property investment. For investors, understanding and adhering to robust legal and regulatory compliance is key to unlocking a secure, transparent, and highly liquid future in real estate. By focusing on compliant platforms and leveraging evolving regulatory landscapes, especially in forward-thinking jurisdictions like Dubai, investors can confidently participate in tokenized property investment, securing their position in this exciting new era.

Related Blogs

blockchain

How Real Estate Tokenization Enhances Liquidity in Traditionally Illiquid Markets

by | 3 months ago

blockchain

Real Estate Tokenization in Dubai: A Blockchain-Powered Investment Revolution

by | 4 months ago

blockchain

Shariah-Compliant Real Estate Investment: How Blockchain Is Empowering Ethical Finance

by | 4 months ago

blockchain

The Complete Guide to Legal & Regulatory Compliance in Real Estate Tokenization

by | 3 months ago